Q.

Can foreigners own property in Panama?

A. Yes. All citizens and foreigners are equal under

the Panamanian Constitution. Anyone can own property

in Panama. And, while not required by Panamanian

law, it is advisable to establish a legal entity

to buy land and engage in the building or purchase

of a house.

Q.

Do foreigners enjoy the same property rights as

Panamanian citizens?

A. Yes, with one exception: foreigners cannot acquire

land within 10 kilometers of the country border

and on islands that have not been declared a special

development area.

Q.

Why do so many foreigners choose to buy a second

home or retirement home in Panama?

A. The main reason that foreign investors have targeted

Panama is cost. Property in Panama is relatively

affordable. Buyers can purchase highly-desirable

property in Panama for less than one third or one

half what they might pay for comparable property

in the U.S.

Buying property in Panama is safe and easy - foreigners

enjoy the same property rights as Panamanians. Additionally,

there is real estate readily available in Panama

to suit all budgets and tastes. From a luxurious

high-rise apartment, to a tropical beachfront condo,

or a breezy mountain retreat, there is a perfect

piece of Panama property for every type of person.

Q. What makes Panama appealing

besides affordable prices?

A.

Panama is the most North-American in makeup of any

nation in Latin America. Panama has most of the

conveniences found in the U.S. from Direct TV, to

American movies, to excellent health care. Plus,

the major cities have the amenities and comparable

infrastructure to the U.S.

Panama

is truly a tropical pardise with almost zero violent

crime and an extremely hospitable attitude toward

foreigners. The country is peaceful, has a low population

density and almost no pollution. It uses the U.S.

dollar as currency so there is never any currency

exchange issues.

Whether

investors just want a place where they can relax

on the beach and surf in the ocean waves, or relax

on a mountain top in the cool highlands, Panama

has it all.

Q.

Why is there a sudden surge in interest in Panama

property as an investment?

A.

Panama's recent vote to start a $5.2 billion expansion

of the Panama Canal will result in a huge injection

of money into Panama's economy. Canal officials

say the expansion, due to be concluded in 2014,

will create up to 40,000 jobs. By 2014, the Canal

is expected to contribute $1.3 billion a year to

the nation's treasury, up from $580 million today.

The entire country will benefit, and real estate,

especially property near the Canal, will likely

appreciate significantly.

Q.

How is title to property held in Panama?

A. The Republic of Panama has one of the most sophisticated

Public Registry systems in the region. The Public

Registry Office keeps records of all titled properties

in all nine provinces of Panama.

Q. Is Panama attractive to retirees?

A. Panama has tried to encourage foreign investment

by appealing to affluent retirees. For that reason,

the requirements to own property and establish permanent

residence are not nearly as onerous as in some other

countries.

Foreign

retirees who want to make their home in Panama must

get a pensioned tourist visa. This visa will include

the right to import up to $10,000 worth of possessions

for personal use duty-free, as well as the duty-free

import of a vehicle every two years.

A

huge plus for retirees, both foreign and domestic,

are discounts of 10%-50% at restaurants and hotels,

for transportation and many medical services, and

for some financial dealings.

Q.

What other retirement incentives are offered for

foreign investors in Panama?

A. Retirees are eligible for many outstanding incentives

that include:

-

Import

tax exemption for household goods

-

Tax exemption to import a new car every two years

-

25% discounts on utility bills

-

25% discount on airline tickets and 30% on other

transportation

-

15% discount on loans

-

1% reduction of home mortgages for homes used

for personal residence

-

20% discount on doctor's bills, 15% on hospital

services if no insurance applies

-

15% off dental and eye exams

-

10% discount on medicines

-

20% discount on bills for professional and technical

services

-

50% discount on entrance to movie theaters, cultural

and sporting events

-

50% discount at hotels during Monday to Thursday,

30% on weekends

Q: Does Panama offer any tax exemptions to foreign buyers?

A: Yes. This tax exemption is an exciting benefit of buying property in Panama and applies to nationals and foreigners who buy property in Panama.

A major incentive to buy a condo hotel unit, or any property for that matter, in Panama is the 20-year property tax exemption law. The law was first passed by the Panamanian government in 1990 as a way to encourage economic growth and investment. The exemption mandates that buyers of new homes or condos do not have to pay property tax for up to 20 years.

After several extensions to the law, it finally expired on August 31, 2007. But, the government saw the benefits of the exemption and introduced new ones of 5 to 15 years depending on a particular property's value.

Developers, real estate agents, and construction companies lobbied the government for the return of the 20-year 'blanket' exemption, but the government wouldn't budge, until now.

In late December, 2007, Panama extended the 20-year tax emption until the end of 2009. This means buyers who close on a property before December 31, 2009 are exempt from paying property tax for 20 years. Maybe it's time to take another look at Panama properties. Of course, buyers should check with a project's developer and/or their personal accountant to ensure that this law applies to their purchase.

Q.

When selling real estate property, does the seller

have to pay a transfer tax?

A. Yes, sellers of real estate are required to pay

a 2% tax for each transfer of property. Real estate

transfer tax can be offset as a direct credit against

the income tax levied on the capital gain arising

from the sale, if any.

Q. What types of property are foreign buyers purchasing

in Panama?

A.

Foreign buyers purchase single-family homes, condominiums

and also a relatively new type of real estate called

condo hotels.

Q.

What are condo hotels and why is it becoming popular

in Panama?

A.

The condo hotel concept has been rapidly gaining acceptance

all over the  world. Panama has joined in by planning

to build several outstanding condo hotel resorts. world. Panama has joined in by planning

to build several outstanding condo hotel resorts.

The

condo hotels are four- or five-star resorts offering

fantastic amenities like full-service spas, fine-dining

restaurants, pools, concierge services and more.

These

vacation homes are ideally suited for international

people buying a second home because owners can use

their condo hotel unit when they want.

When

they're not in residence, their condo can be placed

in the hotel's rental program, and they will receive

a share of the revenue it generates.

Plus,

the hotel takes care of cleaning and maintaining the

property, operating its many amenities, and promoting

it to attract hotel guests. It is hassle-free second

home ownership at its best.

Q. Are Panama condo hotels appropriate for retirees?

A. Yes, they're an excellent solution for retirees

who may want to spend a few weeks or months a year

in a warm climate and a resort atmosphere but don't

want any of the typical responsibilities like property

maintenance associated with home ownership.

General

Information About Panama

Q.

What's the capital of Panama, and what are some major

cities?

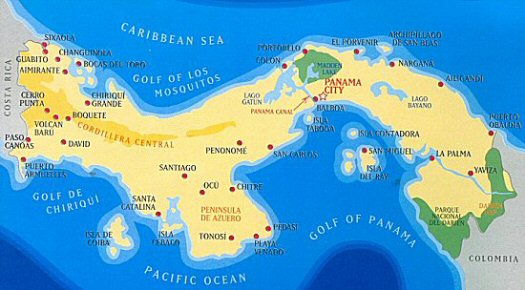

A. Panama has two main cities: Panama City, the capital,

and Colon, on the Caribbean Coast.

Panama

City is the main economic center and Colon is a city

that houses the largest free trade zone in all of

the Americas. David is Panama's third most populous

city and is located at the center of a rich farming

region.

Q.

What about the government and economics of Panama?

A. The government of Panama is democratic and is trying

to make it easier for foreigners to buy real estate

and live in the country.

The

economy is broken down as follows: 74% service, 16%

industry, and 10% agricultural.

The

country's inflation rate has averaged less than 2%

per year over the past 40 years which is extremely

rare south of the United States. Panama's economy

is one of the best performing economies in Latin America.

Q.

What is the climate like in Panama?

A. In Panama, there are two distinct seasons: The

dry season-summer, or verano-(January-May); and the

rainy season-winter, or invierno-(May-December).

The

dry season is considered the tourist season. The rainy

season brings regular afternoon showers of short duration.

Panama City has a an average temperature of 78 degrees

F.

Q.

Where does the word "Panama" come from?

A. "Panama" means "abundance of fish"

in Indian language, and Panama lives up to this name

as a world-class sport fishing destination.

Q.

What is the best way to travel to Panama?

A. Panama has good air connections with destinations

throughout the Americas and part of the Caribbean

and Western Europe. International flights arrive at

and depart from Tocumen International Airport, 15

miles northeast of Panama City.

Carriers

serving Panama with nonstop or connecting flights

include:

American Airlines, Continental, Delta, Iberia, Air

Madrid, Copa (the national airline of Panama), TACA,

LACSA, and Cuban. Another international airport is

expected to open in Playa Blanca, Panama in 2008.

Panama's

gateway cities in the United States are Atlanta, Houston,

Los Angeles, Miami, Newark, Raleigh-Durham and Orlando.

The busiest flight is Miami-Panama City, which takes

just under three hours.

Q.

What are Panama's most popular attractions and tourist

activities?

A. The country's most famous attraction is, of course,

the Panama Canal, the world's grandest shortcut and

one of the great engineering marvels of all time.

It is currently undergoing a major expansion which

will greatly increase its capacity as well as attract

millions of visitors in the coming year. The U.S.

relinquished control of the Panama Canal in late 1999.

There

are several superb tourism activities that can be

easily reached from Panama City. There are five golf

courses in or near the city and beach areas. Dining

is excellent in Panama City, and there are numerous.

bars, discos and cafes. In addition, there is birding,

diving/snorkeling, ecotouring, fishing, hiking, rafting/kayaking,

surfing, and more.

The

Parque Nacional Coiba is one of Panamas's ecological

treasures, and its rich aquatic life has earned comparisons

to the Galapogos Islands.

Panama

boasts the largest number of bird species in Central

America. Bird watchers consider Panama as one of the

world's best birding sights.

Q.

What outdoor activities does Panama offer?

A. Panama's exciting attractions include world-class

deep sea and lake fishing, surfing, wild-water rafting,

kayaking and trekking throughout the country.

There

is also first-class diving and snorkeling in Bocas

del Toro, Coiba Island, the Pearl Islands, Isla Grande,

the Golfo de Chiriqui and even in the Panama Canal.

Q.

Is Panama safe?

A. Yes. Like many countries, Panama sees poverty  and

richness, and often the division is obvious. However,

Panamanians are very charming and welcome tourists

and foreign residents. and

richness, and often the division is obvious. However,

Panamanians are very charming and welcome tourists

and foreign residents.

Q.

What precautions should be taken to avoid health risks

while in Panama?

A. No special precautions are needed for travel in

Panama. The only exception would be for travelers

planning remote and uninhabited parts of the jungle

for several days.

Q.

What currency is used in Panama?

A. The U.S. dollar is the main currency in Panama.

Q.

Do most places in Panama accept American credit cards?

A. Yes. All major credit cards are widely accepted.

Traveler's checks are not as convenient as most banks

and hotels charge a fee for cashing them.

Q.

Are there any national parks in Panama?

A. South of the city of David, the Golfo de Chiriqui

is home to the "Parque Nacional Marino Golfo

de Chiriqui," an immense national marine park

protecting 25 islands, 19 coral reefs and an abundance

of wildlife.

Other

national parks located at the Peninsula de Azuero

are: Montuoso Forest, Reserve, Cerro Hoya National

Park, La Tronosa Forest Reserve, Isla Cañas

Wildlife Preserve, Isla Iguana Wildlife Refuge and

Peñón de la Onda Wildlife Preserve.

Q.

Is living in Panama like living in a third-world country?

A. No, not at all. Panama has a good infrastructure

with excellent services such as Internet access, cable

TV, good cell phone  service and reception, access

to American-style products and services, and affordable

quality healthcare. service and reception, access

to American-style products and services, and affordable

quality healthcare.

In

many retirement havens, foreigners must give up many

of the technologies and amenities they enjoyed in

their home countries. But, in Panama, foreigners will

find that the country offers the state-of-the-art

benefits and conveniences usually found only first

world countries.

Q.

How does the cost of living in Panama compare with

the U.S.?

A. Prices are generally less expensive than in the

United States, but, as with most countries, things

are more expensive in the capital than in outlying

areas.

Food

prices can be comparable or less expensive depending

on whether the product is local or imported.

Healthcare is substantially less costly than in the

U.S.

Q.

Is hiring a maid feasible?

A. Definitely. Most homes are equipped with a maid's

quarters. Typical salary for a maid is approximately

$200 per month plus food and housing.

Q.

Does Panama offer good health insurance?

A. A number of companies offer a wide range of insurance

options. Premiums usually between $40 and $200 per

month, depending on coverage.

Also,

most doctors in Panama are educated in the U.S., and

quality standards in Panamanian hospitals often meet

the standards of hospitals in the U.S. There is at

least one hospital in each of the major cities of

Panama.

Q.

Can foreigners bring their dog or cat to Panama?

A.

Yes, foreigners can bring pets, and the country has

made this a very easy process. A veterinarian located

at the airport will inspect the animal and give it

any required shots.

Pet

owners will be charged a fee for the various forms

and shots, but the animal will not need to be quarantined.

Foreigners should bring all related paperwork for

their pet.

Q.

Does Panama have a reliable banking system?

A. Panama has about 90 banks. Of these 90, over 40

bear a general license, which allows them to provide

general banking services to local and foreign residents.

Panama's

banking system is well regulated, and differs from

other countries in that banks must have a physical

presence (offices, staff, operations, etc.) and comply

with all required laws and asset minimums, as well

as with banking rules and regulations.

Q.

Do foreigners need a visa to visit Panama?

A. Most foreigners enter Panama with a Tourist Visa

or a Tourist Card, which allows them

to visit the country for a 30-day period. The visa

is renewable for two successive periods of 30 days

each, but, the request must be approved by visa authorities.

Currently,

almost all Latin Americans and U.S. citizens are allowed

to enter Panama with a "Tourist Card," which

can be obtained from nearly all airlines flying into

Panama, while the tourist visas are issued by the

Panamanian Consuls.

All

foreigners who stay in Panama for more than 30 days

must be registered with the Immigration Department

and will need an exit permit to leave the country.

A

valid passport is also required to enter the country.

Q.

How can a foreigner obtain a permanent resident visa?

A. Under Panamanian Immigration laws, there are different

kinds of visas that authorize an alien to reside in

Panama provided they meet the established requirements.

Tourist

Pensioner Visa (Turista Pensionada): this is designed

for people whose pension from a government entity

or private corporation is $500 or more ($600 or more

for a couple).

Private

Income Retiree Visa (Rentista Retirado): this visa

is designed for people who, despite not receiving

a monthly pension, are no longer working and have

received a lump sum retirement payment which may be

deposited into a five-year certificate of deposit

with the National Bank of Panama, yielding a minimum

of $750 a month.

Person

of Means Visa (Solvencia Económica Propia):

this visa is designed for those, not employed or starting

a business, but living of their own means. The person

must have a one-year certificate of deposit in any

bank in Panama with a minimum of $100,000. Upon applying

for renewal of the visa, the certificate must also

be renewed for one more year.

Investor

Visa (Inversionista): this visa is designed for those

who want to start a business in Panama with a minimum

investment of $100,000 and a minimum of three permanent

Panamanian employees employed.

Small

Business Investor Visa (Inversionista de Peque?a Empresa):

this visa is designed for those who wish to establish

a small business in Panama with a minimum investment

of $40,000 and a minimum of three permanent Panamanian

employees employed.

Q.

Is the visa application process difficult and expensive?

A. The visa process for the pensionado program is

very simple. It's a one-time application. There are

no renewals and no additional fees.

Other

visa programs require foreigners to file a renewal

each year. This involves time, paperwork, and additional

fees. The process takes only a couple of weeks and

the legal fees are about $1,500.

Q.

Are there general requirements when applying for a

visa?

A. Yes. All visas applications must be made through

a Panamanian lawyer. All overseas documents to be

presented to the authorities in Panama must be notarized

and authenticated by the Panamanian consulate or by

a notary and the Apostille.

The

Apostille (Via the Hague Convention of 1961) is a

quicker way of authenticating documents and is normally

obtained through the Secretary of State in the foreigner's

home state (in the United States) or through the Foreign

Office (in Great Britain). Canadians should check

with the Panamanian Embassy or consulate nearest them.

All

documents must be fresh, (within two months of visa

application) and passports must have at least one

year to run.

A

note regarding dependants: If a spouse will be covered

by your visa, the foreigner will need to bring a marriage

certificate. However, original marriage certificates

are not acceptable if over two months old, so foreigners

may need to obtain new ones.

If

children under 18 are to be covered by the visa, they'll

need to bring fresh birth certificates (not originals).

Q. Do foreigners who own property in Panama have to

pay income taxes in Panama?

A. The Panamanian Fiscal Code defines a taxpayer as

any person or entity (corporation or partnership),

national or foreign, receiving taxable income.

According

to the code, only income that is produced from any

source within the territory of the Republic of Panama

is subject to income tax, regardless of the place

where it is received. This means income from sources

outside Panama is not subject to taxes in Panama.

Q.

Do foreigners who live only part of the year in Panama

have to pay any income tax?

A. Foreigners, who spend 180 days or more in a calendar

year in Panama, are considered residents for income

tax purposes.

If

an individual remains in Panama fewer than 180 days

in a calendar year, and receives income from either

work or other activities in Panama, that individual

is taxed at a 15% fixed rate, plus an educational

tax of 2.75%.

Are

you interested in purchasing a second home in Panama?

To see what's available, visit our Featured

Properties of Panama.

*

The information above is general background about

purchasing property in Panama and is not meant as

a substitute for the advice of your attorney or accountant,

who can take into consideration your individual situation. |